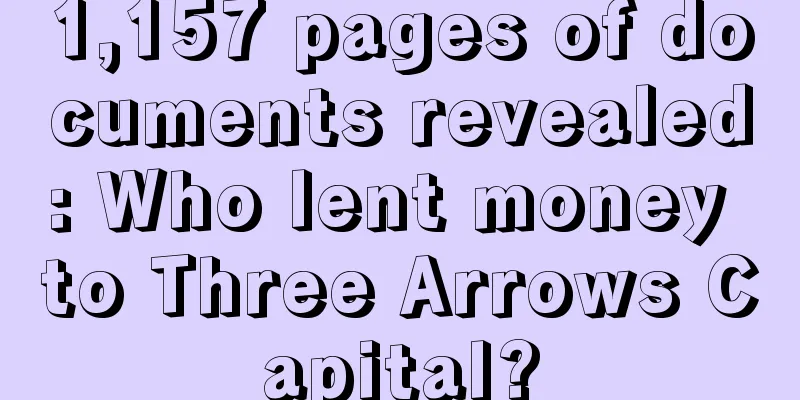

1,157 pages of documents revealed: Who lent money to Three Arrows Capital?

|

With the disclosure of more than 1,100 pages of liquidator documents, it became clear to the outside world who had lent the money to Three Arrows Capital. The total amount owed is US$3.5 billion. Since most of the debts are mortgage loans, the total loss of the institutions should be between US$1 billion and US$1.5 billion. Some of the 32 institutional debtors disclosed in the document are as follows (however, the amounts of some institutions and retail investors are not disclosed in this document): The top borrower is Genesis Lending under DCG. Genesis has always been known for its aggressive lending style and was once one of the largest borrowers of failed institutions such as PayPal Finance. Genesis lent out up to $2.36 billion. Fortunately, it was not an unsecured loan. 3AC's collateral was GBTC, totaling 17,443,644 shares; 446,928 shares of Grayscale Ethereum Trust, 2,739,043.83 $AVAX and 13,583,265 $NEAR. There is still a gap of $462 million. The second-ranked borrower is the well-known "sucker" Voyager, which lent nearly $1 billion to Three Arrows Capital without collateral (calculated based on the value in March), which is currently worth $600 million. Ironically, Voyager emphasized in every financial report: Based on its due diligence, the company believes that the borrower is a high-quality financial institution with sufficient funds to fulfill its due debts. Read more: Revealing the secrets of Voyager, the $1 billion creditor of Three Arrows: Large amounts of deposits from American customers, mainly unsecured loans, face strong regulatory pressure The third-ranked borrower is Deribit, which is also an investor of Three Arrows Capital, with a loan amount of $190 million. The fourth-ranked borrower is the well-known Equities First, with a loan amount of $160 million. Among other borrowers, the Chinese world is more familiar with Coinlist (35 million US dollars); Bitget Exchange (16.32 million US dollars); Mirana/Bybit Investment Department (13.06 million US dollars); Hashkey (440,000 US dollars), etc. According to TheBlock, the creditor committee of Three Arrows Capital (3AC) has been established, consisting of five institutions: DCG, Voyager, CoinList, Blockchain.com and Matrixport. It is worth noting that Blockchain.com did not appear in the above documents, but it claimed that it had lent out $700 million and incurred a loss of $270 million; Matrixport did not appear in the above documents either, and the amount of loans and losses is unknown. |

<<: The recovery is still going on, and the market will not be too bad this week

Recommend

What does a mole on a man's forehead mean?

Men with moles between their eyebrows are general...

The fate of a woman with a mole on her chin Is it good for a woman to have a mole on her chin

In our impression, many people have moles on thei...

Are men with four white eyes difficult to get along with in life?

Generally speaking, people who are difficult to g...

What does a mole on the left hand mean for your fate?

Although not everyone has a mole on the palm of t...

The impact of facial scars on your luck

Although everyone pays attention to facial care, ...

Will nasolabial folds affect wealth? Poor nasolabial fold pattern

Anything that makes a person look less attractive...

The cryptocurrency world is in a siege

Projects that advocate decentralization and uphol...

What does a mole on the bridge of the nose mean?

A mole on the nose represents a person's fort...

What strategies should we rely on to win the flood season? See what the veterans of the mining industry say...

How attractive is the flood season? 70% of Bitcoi...

What do successful men look like?

Whether a man is successful in society has a lot ...

A woman's face tells her fate through her mandarin duck eyes

A person's destiny can be analyzed from the p...

What is a straight eyebrow? How to read a straight eyebrow

Every girl will spend time to dress herself up be...

Amid the Bitcoin and blockchain craze, the U.S. Commodity Futures Trading Commission has begun to pay attention to the digital currency market

As more and more market participants are increasi...

The computing power of mainstream coins has remained at a high level in the past six months. Coins with lower growth rates may have a need to catch up.

1. Weekly Industry News 1. Currently, the total m...

Bitcoin weakened due to lack of volume, while Ethereum rebounded slightly

Bitcoin weakened due to lack of volume and fell b...