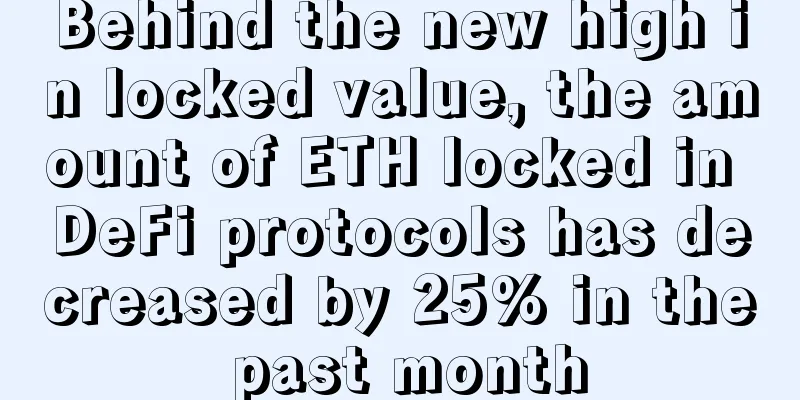

Behind the new high in locked value, the amount of ETH locked in DeFi protocols has decreased by 25% in the past month

|

The total value of tokens locked in DeFi hit a new high on November 24, but surging crypto prices masked a surprising new trend: the amount of ETH locked in DeFi protocols is actually falling. Since November 20, the total value locked (TVL) in DeFi protocols has grown to over $14 billion, reaching an all-time high of $14.39 billion on November 21. The rising prices of Bitcoin and Ethereum have been the source of the continued growth of TVL. Since the beginning of November, the price of BTC has risen by 34% and ETH has risen by 54%. However, according to DeBank data, more than 2 million ETH left the DeFi ecosystem in the same time frame, while the number of Bitcoin-pegged coins has remained relatively stable. ETH locked in DeFi peaked at 9.25 million on October 20, and since then, while TVL has risen by 23%, this is actually due to the rise in ETH prices, and the actual amount of ETH locked has fallen by more than 25%. At the same time, the number of BTC locked has remained basically unchanged, from 164,500 on October 20 to 168,500. So, what is the reason for all this ETH leaving DeFi? One of the most likely reasons is the upcoming release of Ethereum 2.0, a new upgrade of Ethereum that will provide interest returns for staked ETH and eventually reconfigure the entire Ethereum blockchain. The launch of Ethereum 2.0 requires the minimum staking requirement to be met, and according to a report by Rhythm this morning, more than 52,500 ETH have been deposited in the deposit contract address of Ethereum 2.0, meeting the minimum staking requirement. According to previous plans, Ethereum 2.0 is expected to be launched on December 1. The staking requirement of Ethereum 2.0 may be an important reason for users to withdraw funds from DeFi. On the other hand, DeFi users will also feel more cautious as repeated hacker attacks continue to plague many emerging financial protocols, and many DeFi protocols are powerless to deal with hacker attacks and various losses, which may cool down the entire ecosystem. The emergence of Ethereum 2.0 just gives these users who are not completely new to DeFi a new place to put their funds. |

<<: Economic Daily: Why launch digital RMB?

>>: Is Tether the new Bitcoin bubble?

Recommend

BTCC Mining Pool Miners Will Share AISI Token Equity

The AiSi community was founded by a group of earl...

Bitcoin, a sophisticated pyramid scheme?

In 1821, Gregor MacGregor, the self-styled Poyais...

Where is a man's destiny line?

The line of destiny is not one of the three main ...

Analysis of eyebrow bones in men and women

As the name suggests, the brow bone is the bone o...

Is it good to have a mole on the ear?

In traditional Chinese numerology, physiognomy is...

Palmistry of a wise man

Everyone has the need for self-realization, and n...

These faces always know how to strike at the right time

Why do some people always succeed in what they do...

Moles on the ears. Physiognomy. Moles on the ears. Is it good or bad to have moles on the ears?

Moles on the ears, is it good or bad to have mole...

Characteristics of people with fairy spirit

In metaphysics, some people are born with a stron...

ANX CTO: The popularity of blockchain is comparable to that of big data, and the blockchain industry will give birth to the next Google

Hugh休•马登, CTO of Hong Kong-based crypto asset tra...

Rootstock Creates Smart Contract Alliance RSK, 25 Bitcoin Companies Including BTCC Announce Joining

The development of Bitcoin smart contracts is als...

UMC's 8-inch factory is so busy receiving orders that its hands are cramped, but mining chips are still on the rise

UMC stated at a shareholders meeting on the 12th ...

Is it good or bad for a woman to have a mole on the tip of her nose? She has good fortune but her ability to keep money is average!

What does a mole on a woman’s nose mean? As we al...

What does a mole on the palm mean? ★ Palm lines ★

From the perspective of physiognomy, people with ...

How to explain where the mole on a woman's short life is

A person has the most moles on his body, and diff...