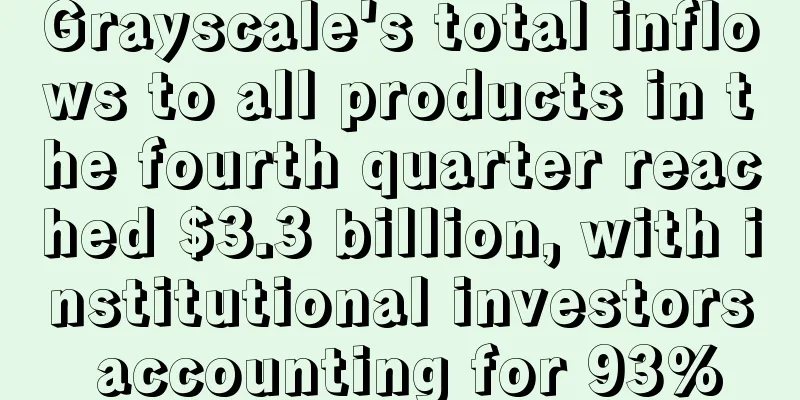

Grayscale's total inflows to all products in the fourth quarter reached $3.3 billion, with institutional investors accounting for 93%

|

According to Chain News, digital asset management company Grayscale Investments released its fourth quarter 2020 financial report, which showed that the total capital inflow for all the company's products in the fourth quarter was $3.3 billion, an average of $250.7 million per week, the largest quarterly capital inflow ever. Grayscale's capital inflows for the whole of 2020 exceeded $5.7 billion, more than four times the cumulative capital inflows of $1.2 billion from 2013 to 2019. The company said that institutional investors are increasingly using Bitcoin as a reserve asset, with 93% of investments in the fourth quarter coming from institutional investors, totaling $3 billion. Its most popular product, Grayscale Bitcoin Trust, accounted for 87% of total inflows, the highest proportion since the second quarter of 2017. |

<<: 7 major cases involving US regulators in the cryptocurrency space in 2020

>>: How is the 2021 Bitcoin Price High Different from 2017?

Recommend

Is the goldfish eye face good or bad?

Goldfish eyes face reading, is it good or bad to ...

"Mining News" Episode 6 Full Review: Opportunities and Challenges in the Halving Callback

Hello, fellow miners and coin lovers, I am Zhang ...

There are moles on the left arm. What do moles on the arm mean?

Everyone has moles on their bodies to a greater o...

Ethereum Layer2 total locked value exceeds $10 billion

DeFi Data 1. Total market value of DeFi tokens: $...

The truth behind FTX’s collapse: Alameda may have gone bankrupt in the second quarter, and its rescue backfired on FTX

1. I found evidence that FTX may have provided a ...

What kind of face makes a man have a good fate

In life, we can infer a person's fortune from...

Buying monkeys is risky! Li Ning, Greenland, and Beaufort bought the boring monkey at high prices and then lost 80%

As the cryptocurrency market went downhill, OpenS...

Wall Street analysts call for environmentally friendly cryptocurrency mining using natural gas

Jean Ann Salisbury, an industry analyst at Bernst...

Secco launches "block tree" technology to devour the banking industry from the outside

Three months ago, Chris Gledhill was working as a...

What does a branch on the fate line mean?

In the palm of your hand, some phenomena will app...

U.S. Department of Commerce discusses blockchain copyright issues

Rage Review : The U.S. Department of Commerce pla...

What is the fortune of people with thick lips?

Detailed prediction of lifelong fortune based on ...

What kind of face does a woman have to have to bring good luck to her husband?

As the saying goes, behind every successful man t...

Several signs of wealth in men

People always talk about a poor look, but if ther...

Why Your Business Needs a Blockchain Dictator

William Mougayar is a Toronto-based entrepreneur,...