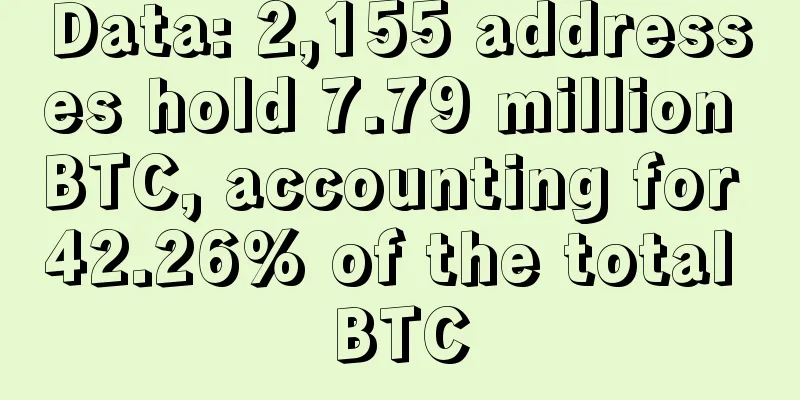

Data: 2,155 addresses hold 7.79 million BTC, accounting for 42.26% of the total BTC

|

Last week, Grayscale announced on Twitter that it had updated the weights of its diversified digital funds. Between March 31 and June 30, the Grayscale Trust’s Bitcoin weight increased by 0.5% and Ethereum’s weight increased by 2.1%. After the adjustment, Bitcoin’s weight was 81.5% and Ethereum’s weight was 11.7%. At the same time, the weights of XRP, BCH and LTC were reduced by 1.4%, 0.8% and 0.4% respectively. Grayscale manages more than $4 billion in cryptocurrency assets. It must be emphasized that the amount of funds flowing into Grayscale Trust in the first half of this year far exceeded the total investment from 2013 to 2019. Data source: Twitter Grayscale has locked up 386,500 BTC in circulation in the form of Bitcoin Trust, which has brought incremental funds on the one hand, and made the market chips more concentrated on the other. The market situation and the concentration of chips are inextricably linked. Recently, there has been a rumor that the top three addresses on the Bitcoin address rich list are ordinary addresses. I checked online and found that the addresses are not correct at all. Most of the top three and even the top ten addresses are not ordinary addresses, but cold wallet addresses of exchanges. Data source: bitinfochart However, the data from the rich list is not very useful for judging the market, and the distribution range of the number of Bitcoin addresses holding coins has a certain impact on the market. According to the figure below, there are currently 2,155 addresses holding more than 1,000 Bitcoins. The number of Bitcoins they hold is nearly 7.79 million, accounting for 42.26% of the total number of Bitcoins. This is the dominant force affecting the market. Data source: bitinfochart Last night, the US stock market opened with a thriving market. The Nasdaq index jumped higher and hit a new record high. The S&P 500 index was also challenging its previous high, and BTC was slightly lifted. This morning, the Nasdaq index filled the gap and closed down 2.13%, and the S&P 500 index closed down 0.94%. BTC also fell under the influence of the US stock market, falling to a low of $9,193. Back to the technical market of BTC, if we analyze it from a technical perspective, Bitcoin has not yet stepped out of the shock range, and the market should continue to fluctuate. The price of BTC has returned to the key position of choosing a direction. The overall sideways pattern is about to end, and the downward momentum is insufficient. However, the U.S. stock market is expected to pull back, and there is also the possibility of a collapse of BTC. Focus on the trend of the U.S. stock market. Data source: Tradingview The mainstream currency should focus on ETH in the medium and long term. After all, Grayscale has laid a good foundation in the past. Litecoin, Ripple, and BCH, these trends are not strong, so we will not participate. Small currencies are rising crazily, and the risks of intervention at this stage are greater than the opportunities. |

>>: US man ordered to shut down ad offering to buy coronavirus vaccine with Bitcoin

Recommend

What does the four transformations of the Palace of Illness represent when they enter each palace?

Disease is the palace of the body, governing appe...

Judging from the face, what kind of man is worth entrusting your life to?

How to tell from his face what kind of man is wor...

What does a mole on the neck mean?

Moles can appear anywhere on the human body, and ...

Exclusive interview with Changpeng Zhao: I can’t understand the extremely high price of NFT, and the headquarters address will be announced soon

Zhao Changpeng revealed that he had bought an apa...

What is the face of a person with crescent eyes?

In fact, everyone's facial features have diff...

Mobile payments giant Square makes money from Bitcoin

On August 2, Square released its Q2 financial rep...

These facial features will help you choose a good mother-in-law

Although an old person in the family is like a tr...

What kind of chin is a sign of great wealth?

In fact, from the perspective of physiognomy, the...

The fate of a woman with a gap in her front teeth

In daily life, everyone’s front teeth don’t mean ...

Blockchain: A new exploration of the rules and technologies of the online world

Editor's note: This article is the preface wr...

Nearly $60 Million in Bitcoin Moved to Ethereum in June

According to Dune Analytics, nearly $60 million w...

What do people with dimples say?

Not everyone has dimples, but people with dimples...

How to remove the mole under the lips?

As one of the traditional physiognomy techniques, ...

What does a mole on the left shoulder mean? Do men with moles on their left shoulders have good fortune?

Everyone has moles on their body to a greater or ...